The Best Strategy To Use For Truck Insurance In Dallas Tx

Wiki Article

Not known Details About Health Insurance In Dallas Tx

Table of ContentsGet This Report about Commercial Insurance In Dallas TxHome Insurance In Dallas Tx Can Be Fun For Everyone3 Simple Techniques For Truck Insurance In Dallas TxThe Facts About Insurance Agency In Dallas Tx Revealed

There are numerous various insurance policies, as well as knowing which is right for you can be difficult. This overview will certainly talk about the various kinds of insurance as well as what they cover.It can cover regular examinations in addition to unanticipated illnesses or injuries. Travel insurance policy is a plan that provides economic protection while you are traveling. It can cover trip cancellations, lost luggage, medical emergencies, as well as various other travel-related expenditures. Travel medical insurance coverage is a plan that especially covers medical expenses while traveling abroad. If you have any questions about insurance, contact us and also ask for a quote. They can assist you select the ideal policy for your requirements. Get in touch with us today if you want personalized service from a licensed insurance agent - Truck insurance in Dallas TX.

Here are a few reasons term life insurance coverage is the most preferred type. To start with, it is affordable. The cost of term life insurance costs is figured out based on your age, health, and also the insurance coverage amount you require. Particular kinds of company insurance might be lawfully necessary in some situations.

HMO plans have lower monthly premiums and also lower out-of-pocket prices. With PPO plans, you pay greater monthly premiums for the liberty to use both in-network as well as out-of-network companies without a reference. Nevertheless, PPO strategies can cause greater out-of-pocket medical costs. Paying a premium is comparable to making a monthly cars and truck payment.

Things about Truck Insurance In Dallas Tx

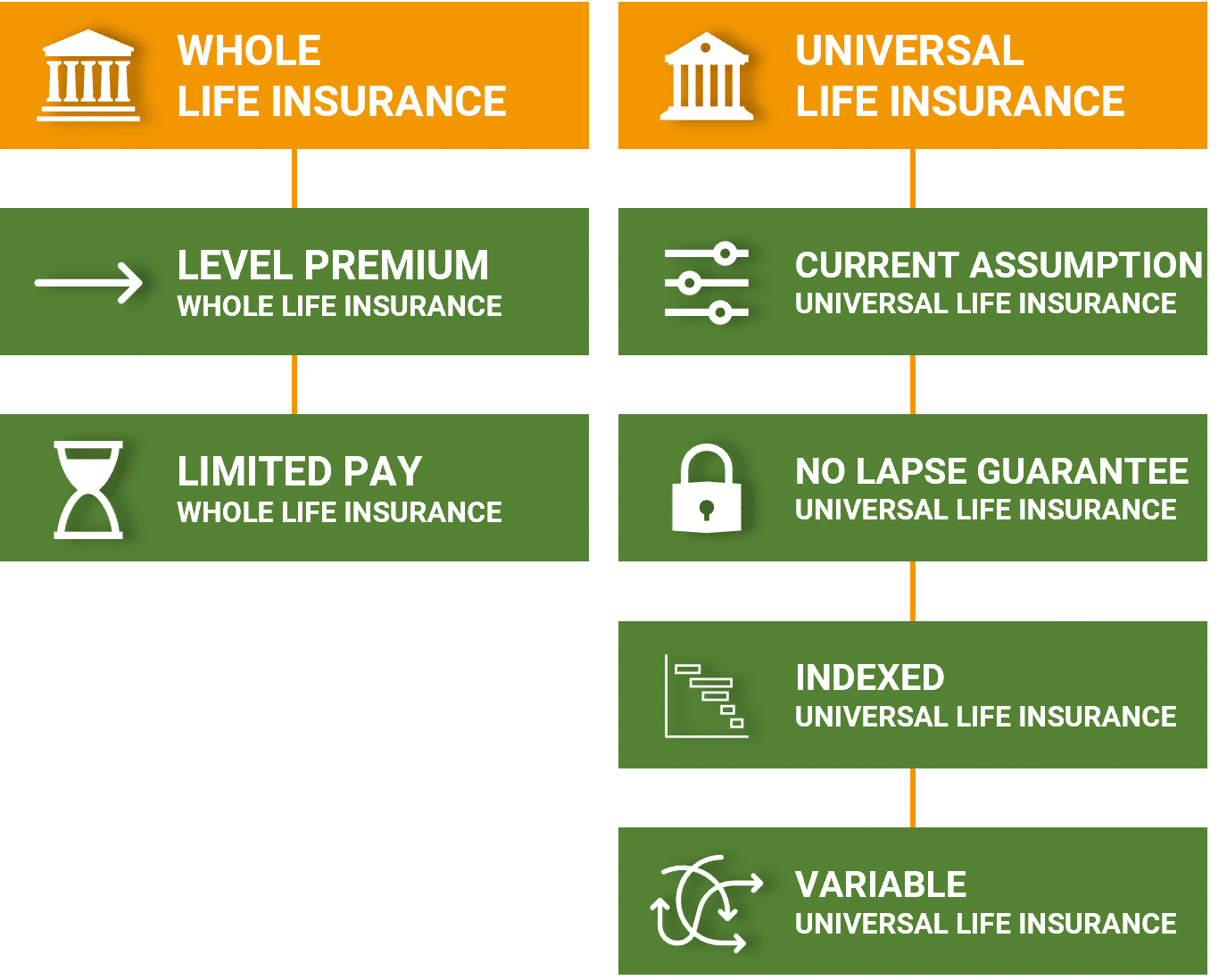

When you have a deductible, you are accountable for paying a particular amount for insurance coverage services before your health insurance provides protection. Life insurance policy can be separated right into two major types: term and also long-term. Term life insurance policy gives protection for a details period, generally 10 to thirty years, and is a lot more economical.We can not avoid the unanticipated from occurring, but often we can protect ourselves as well as our households from the most awful of the economic after effects. Choosing the right type and amount of insurance coverage is based on your specific circumstance, such as kids, age, lifestyle, and work advantages. 4 sorts of insurance policy that the majority of economists suggest include life, health and wellness, vehicle, as well as lasting handicap.

It consists of a death benefit and also a money worth component.

2% of the American population was without insurance policy protection in 2021, the Centers for Condition Control (CDC) reported in its National Facility for Wellness Stats. Greater than 60% got their protection through a company or in the exclusive insurance policy industry while the rest were covered by government-subsidized programs including Medicare and also Medicaid, experts' benefits programs, and the federal industry developed under the Affordable Care Act.

An Unbiased View of Commercial Insurance In Dallas Tx

According to the Social Safety and security Administration, one in 4 workers getting informative post in the workforce will certainly end up being disabled prior to they reach the age of retired life. While health and wellness insurance pays for a hospital stay and clinical bills, you are often strained with all of the expenses that your income had covered.

Nearly all states require vehicle drivers to have car insurance policy and also the few that do not still hold drivers economically in charge of any damage or injuries they trigger. Below are your options when buying car insurance coverage: Responsibility coverage: Pays for residential or commercial property damage as well as injuries you create to others if you're at mistake for an accident and additionally covers litigation expenses and also judgments or settlements if you're sued due to a car accident.

Company coverage is typically the ideal option, but if that is not available, acquire quotes from a number of providers as many offer discount rates my link if you buy greater than one kind of protection.

The 6-Second Trick For Home Insurance In Dallas Tx

The best plan for you will rely on your personal scenarios, just how much insurance coverage you require, as well as just how much you intend to pay for it. This overview covers one of the most typical kinds of life insurance policy policies on the market, consisting of details on exactly how they function, their advantages and disadvantages, the length Visit Your URL of time they last, and also who they're finest for.

This is one of the most popular sort of life insurance policy for most individuals due to the fact that it's economical, just lasts for as long as you need it, and also features few tax policies and restrictions. Term life insurance policy is just one of the easiest as well as most inexpensive ways to offer an economic safeguard for your liked ones.

You pay premiums towards the plan, and if you die during the term, the insurer pays a set quantity of cash, called the survivor benefit, to your assigned recipients. The fatality advantage can be paid as a swelling amount or an annuity. Many people choose to receive the death benefit as a round figure to avoid paying taxes on any made passion. Life insurance in Dallas TX.

Report this wiki page